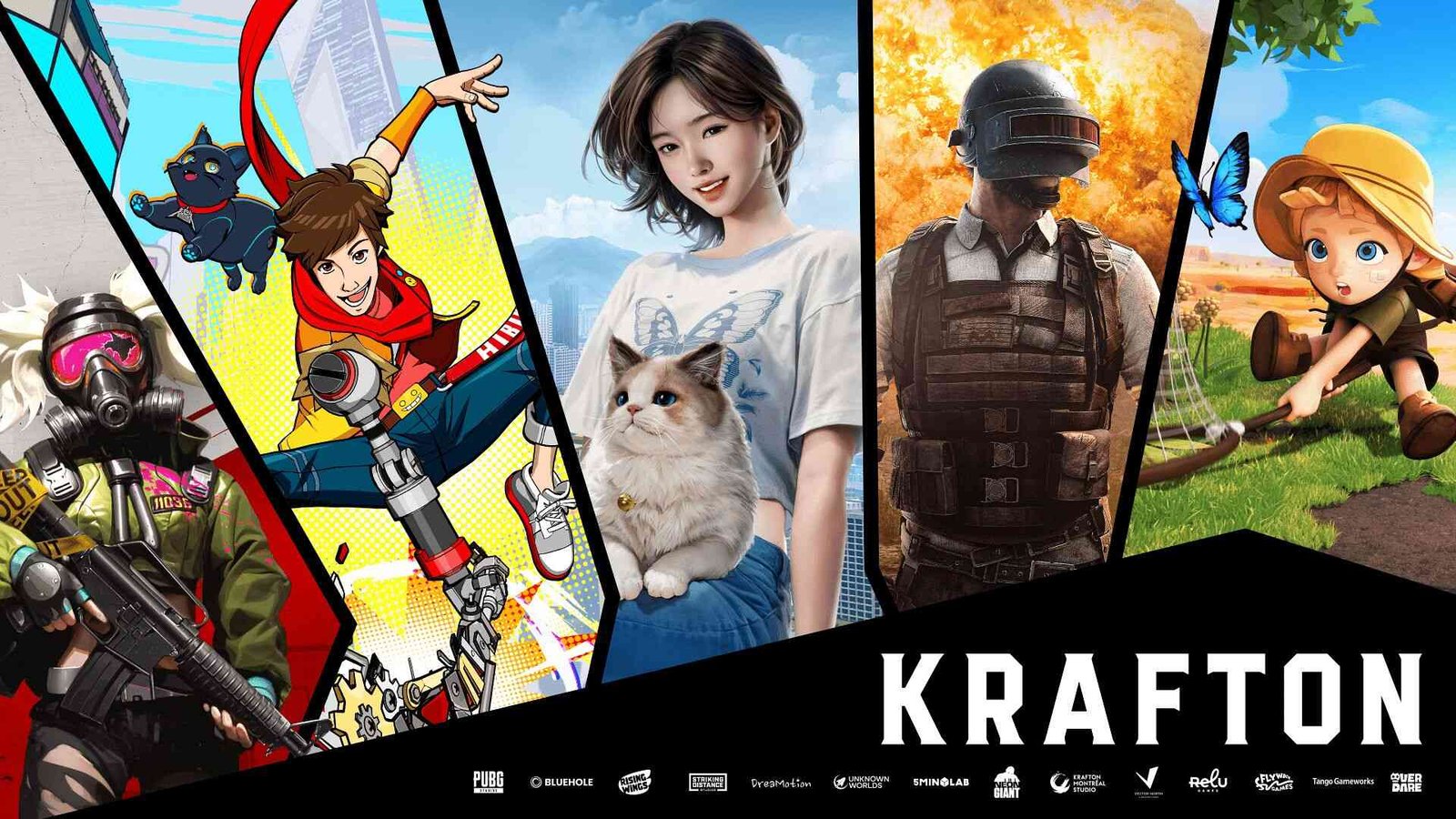

South Korean game developer KRAFTON, the company behind the global sensation PUBG: Battlegrounds, is turning its focus to India, aiming to expand in one of the world’s fastest-growing gaming markets. The move comes as Chinese competitors remain banned in the country.

KRAFTON plans to invest at least $50 million every year in India, where PUBG has been a consistent top-grossing title. The company is also exploring acquisitions as growth slows in China and the US, Sean Sohn, head of KRAFTON India, told the Financial Times.

“Creating another hit like Battlegrounds won’t be easy,” Sohn admitted. “But developing that next big game is our biggest challenge.”

India’s young but price-sensitive gamers

India is home to the world’s largest youth population, with 65 percent of its 1.4 billion people under the age of 35. Yet, Indian gamers are famously price-conscious. Sohn said players may hesitate to spend on games initially, but once they enjoy a title, their loyalty runs deep.

India’s gaming market is still emerging—roughly a fifth the size of South Korea’s $14.4 billion industry. Still, the number of gamers jumped 12 percent last year to 444 million, with nearly one-third spending money on in-game content, according to Niko Partners.

- SUGGESTED FOR YOU: Spotify raises Premium subscription prices in multiple regions globally

Advantage amid Chinese game ban

The ban on Chinese gaming companies gives KRAFTON a unique opportunity in India. The country now ranks among KRAFTON’s top five markets, contributing about 10% to its record sales of 1.5 trillion South Korean won (around $1.1 billion) in the first half of 2025.

PUBG: Battlegrounds, a battle royale game where players fight to be the last one standing on an island, has attracted over 200 million users in India. Analysts estimate the game generates roughly 10 trillion won ($7.7 billion) in annual global sales.

Investing and acquiring locally

KRAFTON has so far invested around $200 million in Indian digital content ventures, making up roughly 9 percent of its global investments. Earlier this year, it acquired cricket game developer Nautilus Mobile for $14 million and led a $53 million funding round for fintech firm Cashfree Payments.

Despite these successes, experts warn that replicating PUBG’s global hit status is no small feat.

“KRAFTON is yet to prove its ability to develop another hit game after Battlegrounds,” said Wi Jong-hyun, a business professor at Chung-Ang University in Seoul. “Unlike in India, Chinese game companies have a strong presence in other emerging markets.”

What to expect now

KRAFTON’s bold moves in India highlight the country’s potential as a gaming powerhouse. While the market is competitive and price-sensitive, PUBG’s popularity shows that Indian players can be incredibly loyal once they find a game they love.